“Hi Dad, I broke my phone. Here is my new number”

"Hi Dad” scams, also known as “Hi Mum” scams, are a type of authorized fraud (scam). These scams typically involve a deceptive impersonation tactic,...

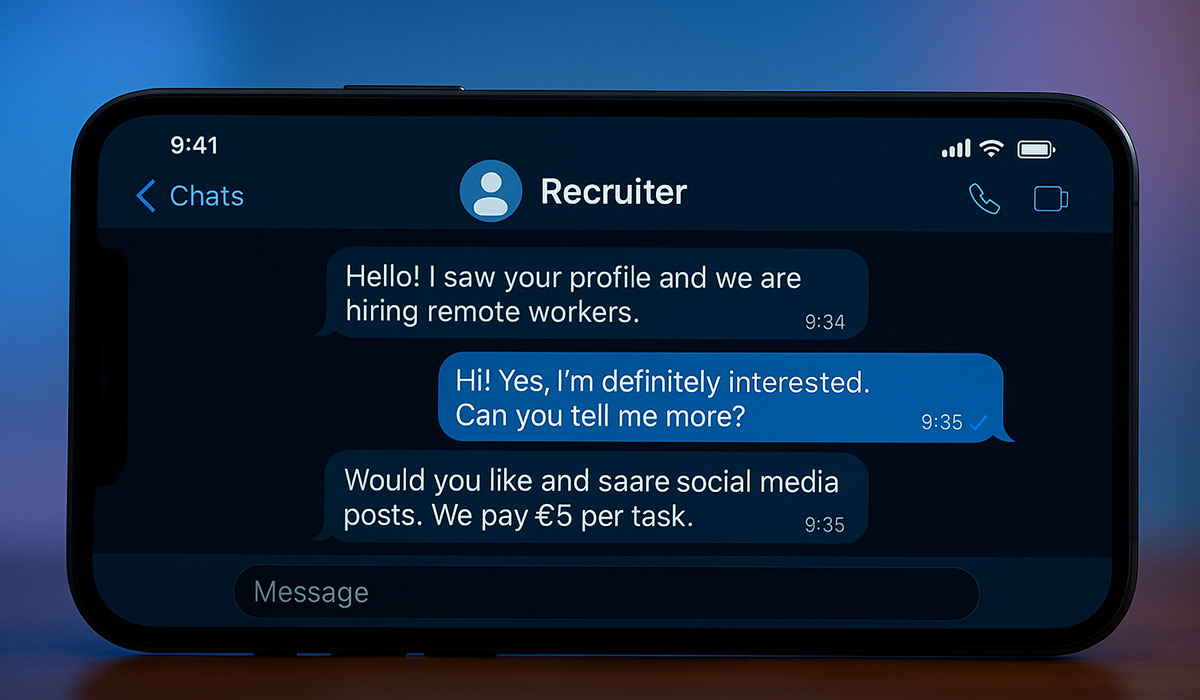

The Fake Job Scam, in particular, is a type of scheme where individuals are tricked into becoming an unwitting money mule on the one hand, and acting as a victim on the other, without realizing it. This type of scam often involves a deceptive recruitment process, where scammers pose as legitimate employers and lure victims with promises of easy online work.

The following outlines the common stages of a typical Fake Job Scam scheme:

Fake Job Scams have evolved with technology and social trends over the centuries. In the 19th century, agents exploited immigrants by charging fees for nonexistent jobs or transport. As the job market matured, scams shifted to include fake job agencies and telemarketing schemes demanding upfront payments.

With the rise of the internet, scams expanded to fake listings on job boards and platforms like LinkedIn. In addition, the removal of cultural and language barriers and the increase in remote work have also led to a significant increase in job-related scams. For instance, the US Federal Trade Commission reported that job-related scams nearly tripled from 2020 to 2024, with financial losses rising from $90 million to $501 million.

Today, scammers use cutting-edge methods like deepfake interviews to impersonate recruiters and synthetic identities to create realistic but entirely fake job profiles. Fake Job Scams have evolved from simple deceptions to complex, technology-driven schemes. As scammers continue to adapt, job seekers must remain vigilant, verify opportunities through official channels, and be wary of unsolicited offers that seem too good to be true.

So why have Fake Job Scams become the go-to for fraudsters?

What follows is an analysis of fake job scams, evaluated across four critical dimensions using a 0–10 scale

(0 = very low, 10 = very high):

Modern fake job scams require minimal upfront investment. Scammers often utilize free or low-cost tools to perpetrate their schemes:

In some cases, scammers may invest in more sophisticated setups, such as cloned websites or AI-generated content, but these are exceptions rather than the norm.

The risk of apprehension for scammers is relatively low due to several factors:

However, when scams involve substantial amounts or high-profile victims, law enforcement agencies may prioritize investigations, increasing the risk for perpetrators.

Fake Job Scams have a high success rate due to:

Moreover, despite being digitally savvy, individuals from younger generations are more susceptible to job scams due to overconfidence in digital spaces, financial pressures, high social media exposure, and limited job market experience.

The ROI for job scams is exceptionally high:

Job Scams offer a very attractive return on investment for fraudsters.

| Category | Score (/10) | Key Insights | |

| 1 | Initial Investment | Very Low · 2/10 |

Minimal setup costs using free or inexpensive tools |

| 2 | Exposure Risk | Low · 3/10 |

Low risk due to anonymity and cross-border challenges |

| 3 | Success Rate | High · 8/10 |

High effectiveness through emotional manipulation and credible impersonation |

| 4 | Return on Investment | Very High · 9/10 |

Significant financial gains with minimal expenditure |

Job scams are highly lucrative for fraudsters, requiring little investment and offering substantial returns. The combination of low exposure risk and high success rates makes this form of fraud particularly attractive to cybercriminals. Awareness and vigilance are crucial for job seekers to protect themselves against such schemes.

If we think of Job Scams from the financial institutions’ point of view and whether or not they are equipped to protect themselves and their customers against them, there are some significant challenges to be tackled. Here are some of them:

To effectively track the lifecycle of an account and anticipate potential misuse, robust account classification is crucial. By categorizing accounts based on their typical behavior, financial institutions can better detect subtle shifts that might indicate emerging risks. This approach allows for continuous assessment, even when signals are weak or fragmented.

However, simply relying on classification isn’t enough. It is equally important to maintain a vigilant watch on all available signals, including those that might typically be dismissed as false positives. Early detection requires a holistic view of account activity, from transaction patterns to digital behavior, ensuring that potential scams are intercepted before they escalate into significant threats.

Here are some real-life job scam examples that have been made public through traditional media in various regions. The real financial losses incurred by citizens through these types of scams are monumental.

A 26-year-old woman named Rachael fell victim to a job task scam where she was offered an online, commission-based role. Initially, she received small refunds, leading her to believe the job was legitimate. However, when she refused to pay more, the scammers became hostile and threatened her, stating they had her personal information. She lost £7,995 before realizing it was a scam.

Martin Carroll, a 64-year-old IT expert from Queensland, lost $25,000 in a job scam just two years before his planned retirement. He was lured by a fake job opportunity that promised weekly payments for filling online shopping baskets. Despite initial skepticism, he was encouraged by a WhatsApp group and started working for a company called Ruri. He paid for items, expecting reimbursement and commission, but only received one payout. The scammers then introduced high-cost “special buys,” leading Carroll to spend more money. Realizing it was a scam, Carroll quit but had already lost his savings.

In December 2024, the National Police arrested a 23-year-old woman in Jerez de la Frontera, accused of defrauding 1,580 euros through fake job offers in the name of a well-known sports retail chain. The suspect sent emails impersonating the company, asking victims to make payments for “administrative procedures”, which she promised to reimburse once the position was secured. Two young individuals fell for the scam. The fraudster was charged with fraud and identity theft.

Monika Zytowiecka, a 38-year-old business owner from Southampton, lost nearly £4,000 in a single day after falling prey to a cryptocurrency scam promoted as an online side hustle on Facebook. The scam initially promised earnings of up to £250 a day for processing online orders. She was instructed to make online orders using a budget, assured of refunds with added commission. Initially, she received her money back with commission, gaining her trust. However, she was asked to make increasingly larger top-ups, leading to nearly £4,000 being lost when the sales platform and scammers disappeared.

These examples represent just a fraction of the fake job scams circulating today. Many victims never come forward, often due to feelings of shame or the limited legal avenues available for recourse. As a result, countless cases remain hidden, making the true scale of the issue far greater than we might imagine.

Fake job scams have evolved significantly over time, leveraging both psychological manipulation and technological advancements to exploit unsuspecting job seekers. These scams, ranging from low-investment, high-return schemes to sophisticated AI-driven tactics, pose a significant challenge to individuals and financial institutions alike. They prey on the financial vulnerabilities of their targets, creating a dangerous cycle where victims unknowingly become part of fraudulent networks.

These cases highlight the diverse methods scammers use to exploit and combat this growing threat, it is crucial for job seekers to remain vigilant, verify job offers through official channels, and be cautious of unsolicited contacts promising easy money.

Financial institutions also need to invest in advanced fraud detection technologies, account classification, and pre-fraud signal analysis to prevent their customers from becoming unwitting money mules.

As technology and regulation continue to advance, so will the tactics of scammers. Staying informed, adopting robust security practices, and fostering a culture of digital awareness are critical steps toward reducing the impact of these pervasive schemes.

"Hi Dad” scams, also known as “Hi Mum” scams, are a type of authorized fraud (scam). These scams typically involve a deceptive impersonation tactic,...

What are CEO Scams? CEO scams are a form of social engineering where fraudsters impersonate senior executives to manipulate targets into redirecting...

Acoru, a pioneering cybersecurity firm in the fraud and scam detection space, has officially launched its operations following a successful period...