"Urgent Request from the CEO": Don't fall for the CEO Scam

What are CEO Scams? CEO scams are a form of social engineering where fraudsters impersonate senior executives to manipulate targets into redirecting...

3 min read

Acoru : Jun 9, 2025 11:09:37 PM

Imagine this:

A fraudster steals your credit card details online and uses them to make a purchase on an e-commerce site. The site’s fraud tool checks the transaction amount, merchant ID, and country, and sees nothing out of the ordinary.

Meanwhile, your bank, which issued the card, has fraud detection systems too. But those systems don’t know that just a few hours earlier, someone accessed your account using a new device and extracted your CVV code. The transaction gets approved, and the fraudster walks away with your money.

And now imagine this:

You receive a call from someone claiming to be from your bank. They tell you there’s a suspicious purchase on your account: €1,000 spent on a TV you recently bought. They know the exact model, date, and amount, so you believe them. The caller offers to help reverse the charge but needs you to approve a push notification on your banking app. You do. What you don’t know is that the caller is a scammer who used stolen credentials to access your account and is now guiding you to authorize a fraudulent transaction yourself.

The problem for each of these cases is: your bank’s systems may not flag either of them as suspicious.

![]() The push approval seems legitimate

The push approval seems legitimate![]() The device matches your own

The device matches your own![]() The transaction doesn’t exceed any limits

The transaction doesn’t exceed any limits ![]() And the call? That happens on a completely different channel - one that no fraud detection system is monitoring.

And the call? That happens on a completely different channel - one that no fraud detection system is monitoring.

This is what we call cross-channel fraud. And in both of the examples provided, the systems behind them operate under a multichannel approach.

Most financial institutions and solution providers operate in what is called a multichannel architecture. This means they have tools covering various areas of the customer journey: onboarding, transaction monitoring, session behavior, card payment analysis, etc. These tools are often best-in-class in their respective domains, but they don’t communicate effectively.

Here’s how it typically works:

Each of these systems may raise its own flags, but rarely do they connect the dots. At best, it involves coordinating two specific channels with a defined entry and exit point. For example, Channel A may feed into Channel B, enhancing the customer experience on a session-by-session basis. However, this interaction is linear and limited in scope. This disjointed view results in missed fraud signals that span across different moments and channels in the user journey. It’s like trying to solve a puzzle with only a handful of scattered pieces.

Going back to the examples:

The first example is the reality of Card-Not-Present (CNP) fraud, and it’s a prime example of what happens when channels don’t talk to each other. It’s not that banks and retailers don’t have systems in place; it’s that those systems operate in isolation. This fragmentation leaves significant gaps in fraud detection, and fraudsters know it.

The second example is a Scam Phish Attack, a sophisticated evolution of phishing where criminals exploit multiple communication channels (email, SMS, voice calls, and push notifications) in real time. It’s not just about stealing login credentials; it’s about manipulating victims into actively participating in fraud.

Omnichannel orchestration goes beyond covering multiple channels: it integrates them into a cohesive, intelligent system. It enables institutions to correlate data across all user touchpoints, creating a unified risk profile that updates continuously.

It offers seamless integration across all available channels. It allows for any channel to serve as an entry or exit point, enabling dynamic and flexible interactions. A customer might start their journey on Channel A, continue through Channels B and C, and complete the experience on Channel D. Alternatively, they might begin on Channel D, move through B, and conclude on A. This level of fluidity and interoperability is the hallmark of a true omnichannel strategy — and it is a capability few providers can offer.

With omnichannel orchestration, what was once invisible becomes visible. Events that seem normal in isolation suddenly raise red flags when viewed together. Its level of deep integration and temporal awareness allows fraud teams to detect and act on threats that otherwise go unnoticed in a multichannel setup.

In a landscape where fraud techniques grow increasingly sophisticated, omnichannel orchestration is no longer a luxury: it’s a necessity. Only by bridging fragmented signals into a unified narrative can organizations stay ahead of scammers and protect both users and assets.

Want to learn more about how Acoru can do this?

Reach out to our team for more information.

What are CEO Scams? CEO scams are a form of social engineering where fraudsters impersonate senior executives to manipulate targets into redirecting...

"Hi Dad” scams, also known as “Hi Mum” scams, are a type of authorized fraud (scam). These scams typically involve a deceptive impersonation tactic,...

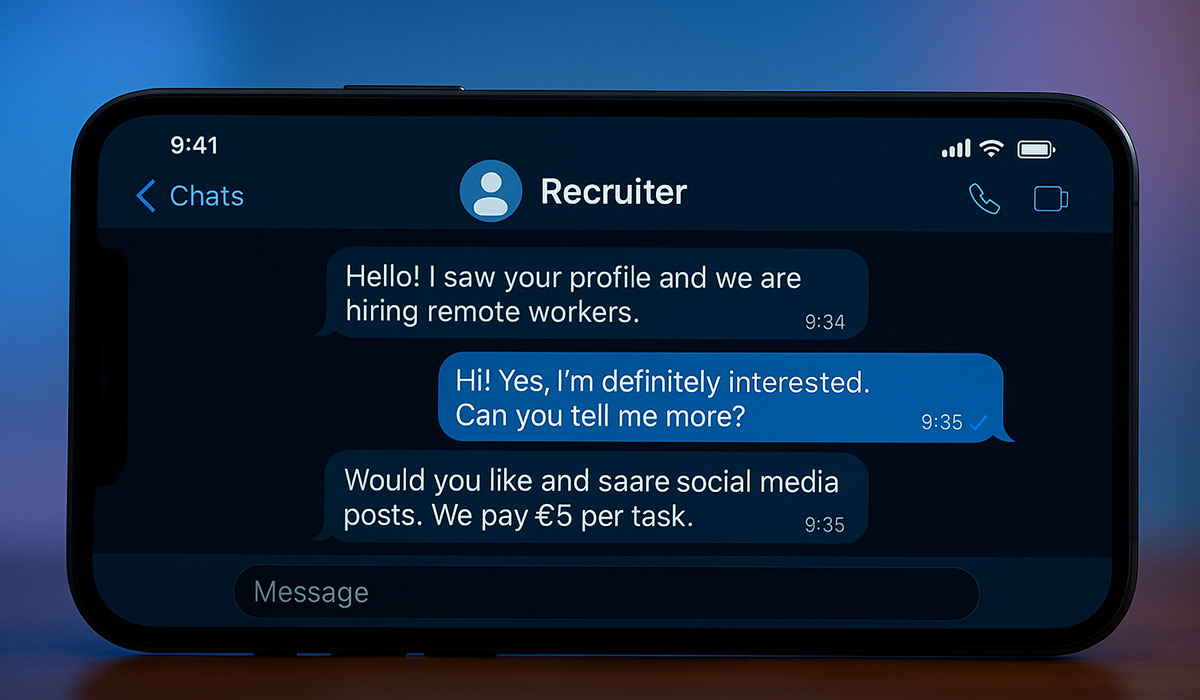

Fake Job Scams are a specific type of authorized fraud (scam). Authorized fraud happens when the person initiating the transaction is the legitimate...